A recent survey by Liberty Insurance has shown some interesting facts about Irish homeowners and their security habits. The study carried out by Millward Brown on behalf of Liberty Insurance shows that a huge number of homeowners in Ireland have a very lax attitude to home security.

Some of the most telling facts and numbers to come from the survey are:

- 47% of people don’t have a house alarm – with only 1 in 3 who do using it regularly

- 23% of Dublin homeowners are likely to leave doors unlocked

- 22% of people rely on neighbours to watch their home

- 17% of people don’t lock their front door

- 1 in 3 people feel relaxed leaving their home unattended

With most burglaries being opportunistic crimes as opposed to planned crimes, the figures above are a stark reminder that home security should be paramount in homeowners minds, but often this is obviously not the case. With this in mind the simple 3-word message which can help you keep your home secure is:

CHECK – LOCK – LEAVE.

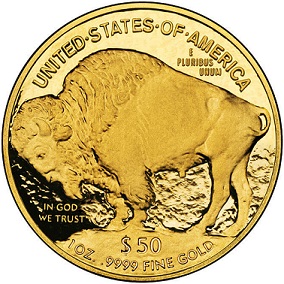

To keep your valuables completely safe & secure renting a safe deposit box is also a good idea. At Merrion Vaults you can rent your own private safe deposit box with access 7 days a week from less than €4 per week.

Call Merrion Vaults today on: (01) 254 7900 or go to www.MerrionVaults.ie